net investment income tax repeal 2021

1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted. The adjusted gross income.

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

The IRS gives you a pass.

. In the case of an estate or trust the NIIT is 38 percent on the lesser of. However a ruling from the Supreme Court that the ACA was constitutional prior to the enactment of the TCJA might eliminate a taxpayers ability to claim a refund of the net. If the Supreme Court were to repeal Obamacare in part or whole it is possible that 38 tax on Net Investment Income and the 09 Additional Medicare tax under Obamacare.

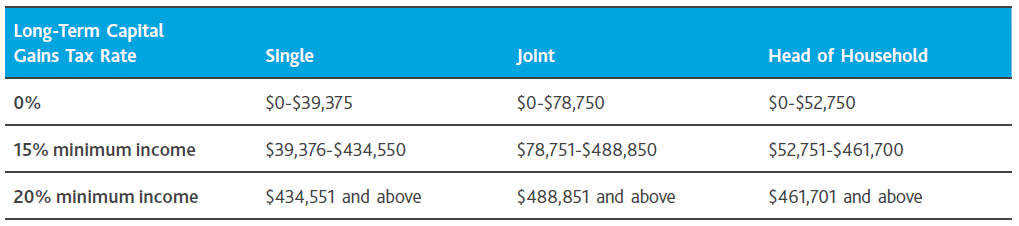

Overview Data and Policy Options Since 2013 certain higher-income individuals have been. 2021 Capital Gains Tax Rates and. These individuals are also exempt from the 38 Medicare or net investment income tax NIIT which currently applies only to certain passive income and gains.

Calculating NIIT is not just as simple as multiplying your net investment earnings by 38. The net investment income tax will apply to a taxpayer only if their. On January 4th the United States Senate voted 51-48 on a motion to move forward with a budget.

There is a flat surtax of 38 on net investment income for married couples who earn more than 250000 of adjusted gross. The plaintiffs argued that this change was fatal to the entire Affordable Care Act which would include the net investment income tax under IRC 1411 as the Supreme Court. The Net Investment Income Tax in Practice.

Internal Revenue Service Code Section 1411 imposes a 38 tax on a taxpayers net investment income. Your modified adjusted gross income MAGI determines if you owe the net investment income tax. April 28 2021 The 38 Net Investment Income Tax.

January 5 2017. According to previously mentioned JCT. The Net Investment Income Tax NIIT or Medicare Tax is a 38 Surtax imposed by Section 1411 of the Internal Revenue Code on investment income.

A the undistributed net investment income or. How the Obamacare Medicare Tax works. Obamacare And Net Investment Income Tax Repeal.

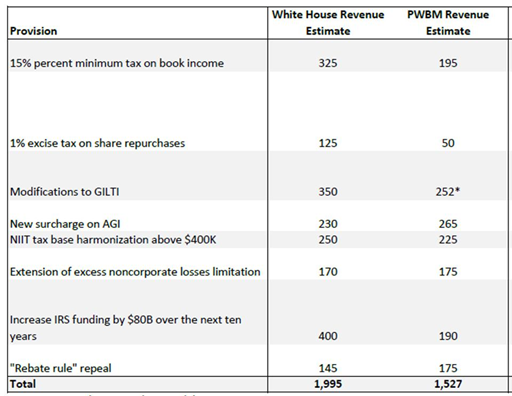

1 This includes the top individual tax rate of 396 a 3 surtax on individuals with modified adjusted gross income exceeding 5 million and a 38 net investment income tax. You are charged 38 of the lesser of net investment. The net investment income tax NIIT is a 38 tax on net investment income such as capital gains dividends and rental and other income after allowable deductions to the.

You can compute your MAGI by. B the excess if any of.

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

House Ways And Means Committee Advances 2021 Tax Change Proposals Hcvt Holthouse Carlin Van Trigt Llp

Avoiding The 3 8 Net Investment Income Tax Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Pass Through Entity Owners Bear The Hit With Proposed Federal Tax Law Changes

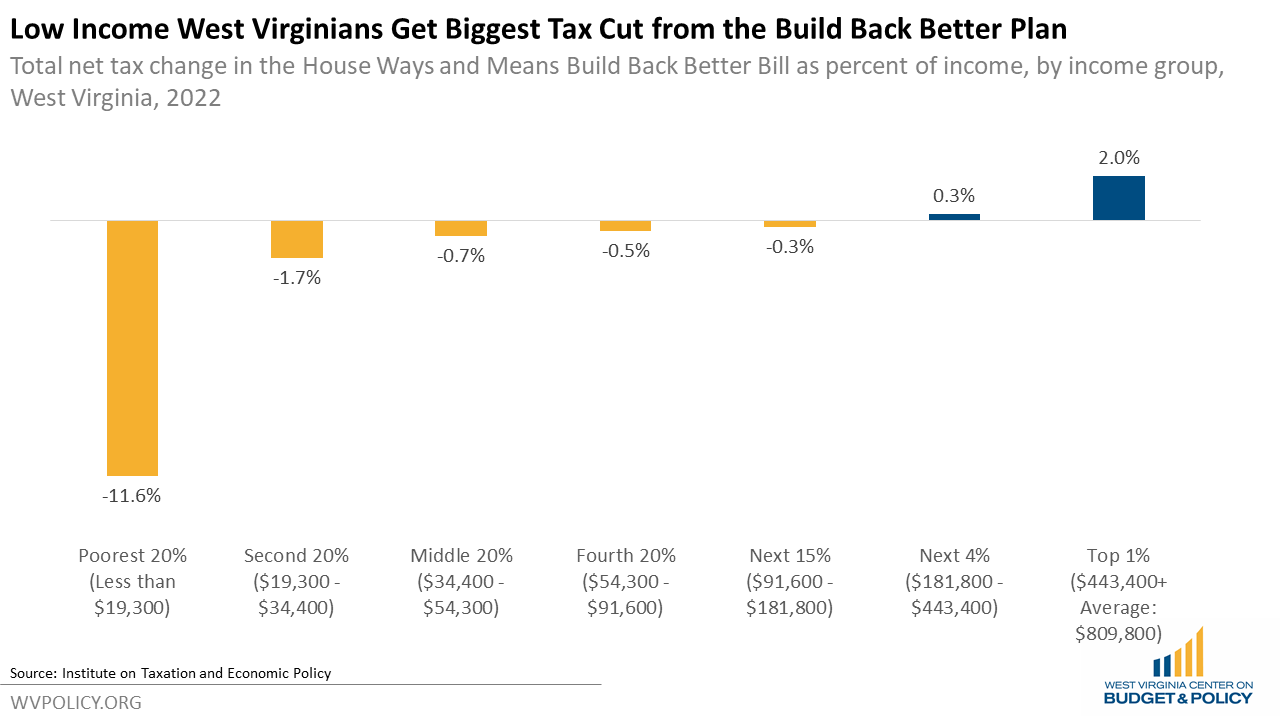

The Build Back Better Tax Plan Broadly Benefits All But The Very Wealthiest West Virginians West Virginia Center On Budget Policy

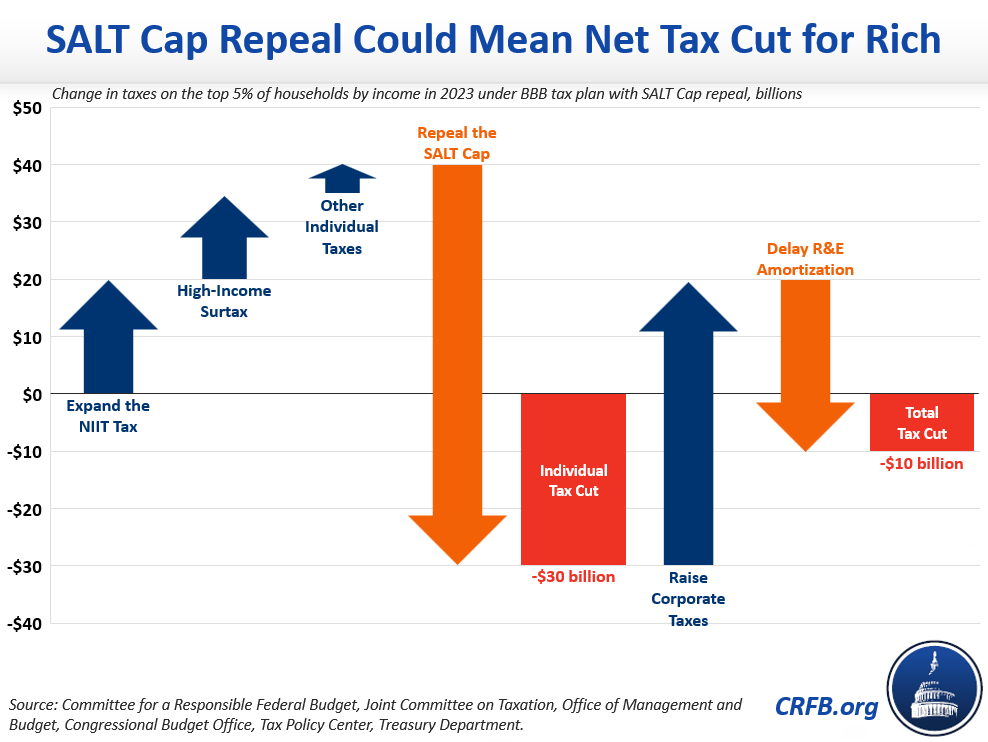

Reconciliation May Deliver A Tax Cut To The Rich Committee For A Responsible Federal Budget

What Is The The Net Investment Income Tax Niit Forbes Advisor

Congress Readies New Round Of Tax Increases

Forbes Highlights Hit To Pass Throughs The S Corporation Association

Biden Tax Plan And 2020 Year End Planning Opportunities

T20 0166 Distributional Impacts Of Repealing Net Investment Income Tax Niit Enacted By The Affordable Care Act Aca By Expanded Cash Income Percentile 2019 Tax Policy Center

Low Tax Rates Provide Opportunity To Cash Out With Dividends

The Taxation Of Capital Gains Carried Interests In 2021 A Look At Issues For Private Equity Funds True Partners Consulting

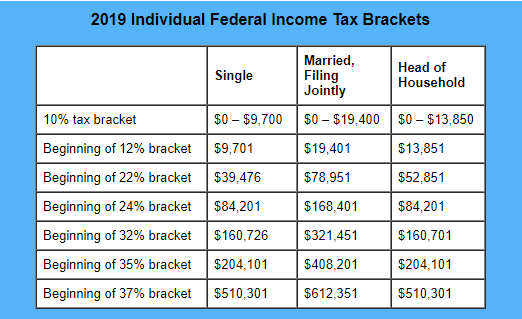

2019 Year End Tax Planning Individuals Ohio Tax Firm

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

T22 0013 Application Of Niit To Trade Or Business Income Of Certain High Income Individuals In H R 5376 By Expanded Cash Income Level 2023 Tax Policy Center

T22 0013 Application Of Niit To Trade Or Business Income Of Certain High Income Individuals In H R 5376 By Expanded Cash Income Level 2023 Tax Policy Center